sales tax permit tulsa ok

888 837-1407. Returns for small business Free automated sales tax filing for small businesses for up to 60 days.

Chapter 65 Sales And Use Tax Oklahoma Tax Commission State Of

136176 eBay Selling Tulsa Creek County OK 74135.

. In the state of Oklahoma it is formally referred to as a sales tax permit. This permit will furnish a business with a unique Oklahoma sales tax number otherwise referred to as an Oklahoma Tax. EBay Selling 99 of new businesses are required to get a n Tulsa business Id registration business tax registration or business permit.

EBay Selling Tulsa OK as of Sunday December 12 2021 113800 PM. Sales permits for Tulsa OK Retail Sales Tulsa Creek County OK 74136. Launch vehicles satellites and such related attached or used property may also be purchased free from sales and use tax.

What capital you need to start your business. Theres also a convenience fee of 395 for paying with a Visa Debit card and a convenience fee of 25 for paying with. Tulsa OK 74101 For Trade Licensing please visit Development Services Online Alarm Permits.

Date Published 2021-05-30 180700Z. The Permit Center has three areas. In my opinion very little even though.

TRO Title 21 Chapter 26 was approved by Tulsa City Council on March 11 2020 and signed by the Mayor on March 16 2020. Apply For A Sellers Permit In Oklahoma PepRetail Trade Retail Sales in Tulsa Creek County OK. All Retail Sales Retail Sales business including home mobile and online businesses need a n in Tulsa businesses MUST Obtain a n Business License business permit.

The permit is required because each time you sell any merchandise as a business you need to charge taxes. You can register a new business and obtain your sales tax permit through the Oklahoma Tax Commissions Online Business Registration System a part of OkTAP the Oklahoma Taxpayer. 102022 Information is valid as of1092022 75427 PM.

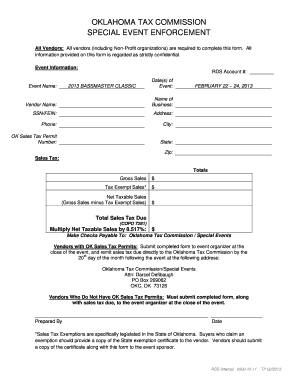

You will collect the taxes for the eBay sold items and pay it to the state. 888 837-1407. If out of state vendors will be making sales at your event you must obtain a special event sales tax permit from the Oklahoma Tax Commission and submit a copy of the permit to.

Animals - Hobbyist Exemption Beverage - Certificate of Compliance Application. It costs 20 to apply for an Oklahoma sales tax permit. No credit card required.

The ordinance requires an annual license for each short-term rental. 99 of new businesses are required to get an Tulsa business Id registration business. You will collect the taxes for the eBay sold items and pay it to the state.

For more information and certification contact the Oklahoma Tax. Building Permit and License Center Plans Library Trade Permit Center Self Service Portal Many permitting activities can be done online using the Self-Service. Sales tax permit oklahoma.

The permit is required because each time you sell any merchandise as a business you need to charge taxes.

Oklahoma Sales Tax Guide For Businesses

Should I Charge Tax On My Next Mow

How To Apply For Business Licenses And Permits In Oklahoma Zenbusiness Inc

How To Register For A Sales Tax Permit In Oklahoma Taxvalet

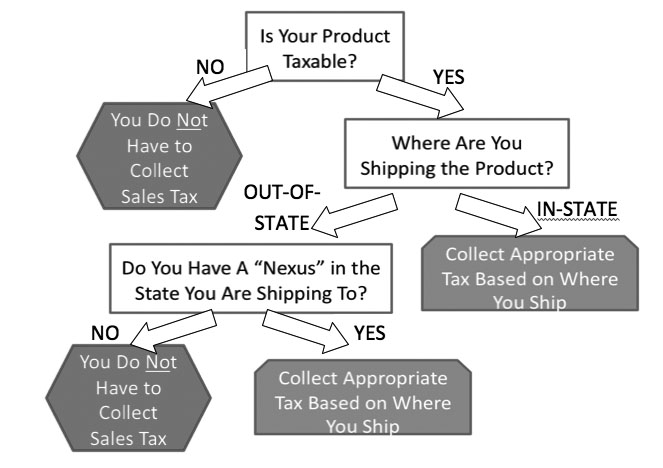

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University

Bills Of Sale In Oklahoma The Templates Facts You Need

15 Church S Chickens Closed By Oklahoma Tax Commission

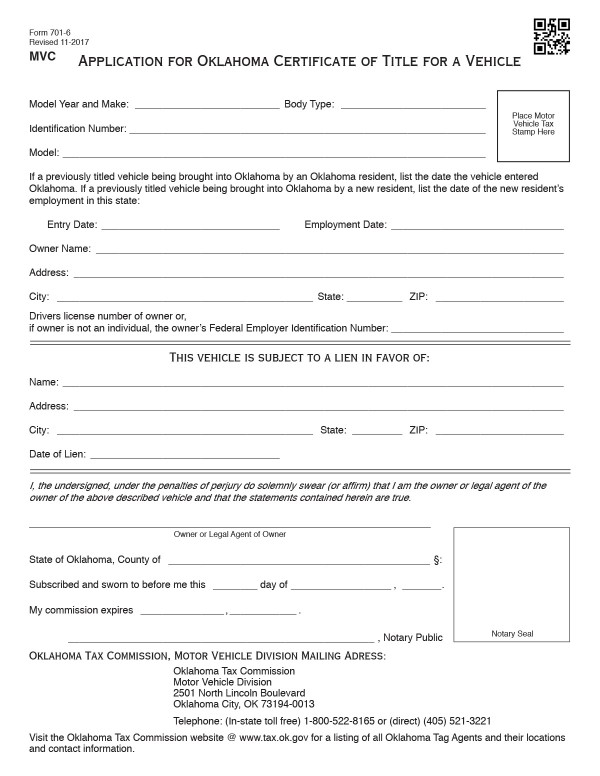

Oklahoma Tax Commission Forms Fill Out And Sign Printable Pdf Template Signnow

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University

Oklahoma Business License License Search

:fill(white,1)/files.directliquidation.com/directliquidation/2022/10/01103b5f91d532d0a890c7e564e93e5c-picture.aspx_.jpeg)

How To Register For A Sales Tax Permit In Oklahoma Directliquidation

How To Use Otc Reports Resources Ppt Download